Fed Rate Cuts 2024: What We Expect From Market

The Federal Reserve, or "the Fed," is a key player in determining the course of the US economy.

The federal funds rate is a powerful weapon that it uses to influence borrowing costs, GDP growth, inflation, and jobless rates.

After a lengthy period of rate rises to contain inflation, there is increasing anticipation that the Fed may shift toward rate reduction in 2024. The economy, companies, and consumers might all feel the effects of these cutbacks. This article delves into the likely market reactions across industries if the Federal Reserve decreases interest rates in 2024.

Following economic disruptions caused by the COVID-19 pandemic and global supply chain concerns, inflation skyrocketed to unprecedented heights, prompting the Federal Reserve to go on a rate-hiking binge in recent years.

The Federal Reserve hoped to calm down an overheated economy, curb inflation, and put prices under control by increasing interest rates. Consequently, the federal funds rate hit levels not seen since the pre-crash period of 2008. The Federal Reserve may change its emphasis from containing inflation to boosting economic growth if inflation starts to moderate and the economy shows signs of stabilizing. The standard procedure for reviving a flagging economy is to lower interest rates.

They make borrowing money cheaper for both companies and individuals, which in turn may boost investment, consumption, and lending. If inflation stays in check and economic growth slows down, economists at Bloomberg predict that the Fed might lower interest rates for the first time by mid-2024.

By taking this action, the government may hope to stave off a recession, which might happen if consumer demand starts to decline or if employment rates start to fall. If inflation gets back to the Federal Reserve's target rate of 2%, policymakers may switch from raising rates to cutting them.

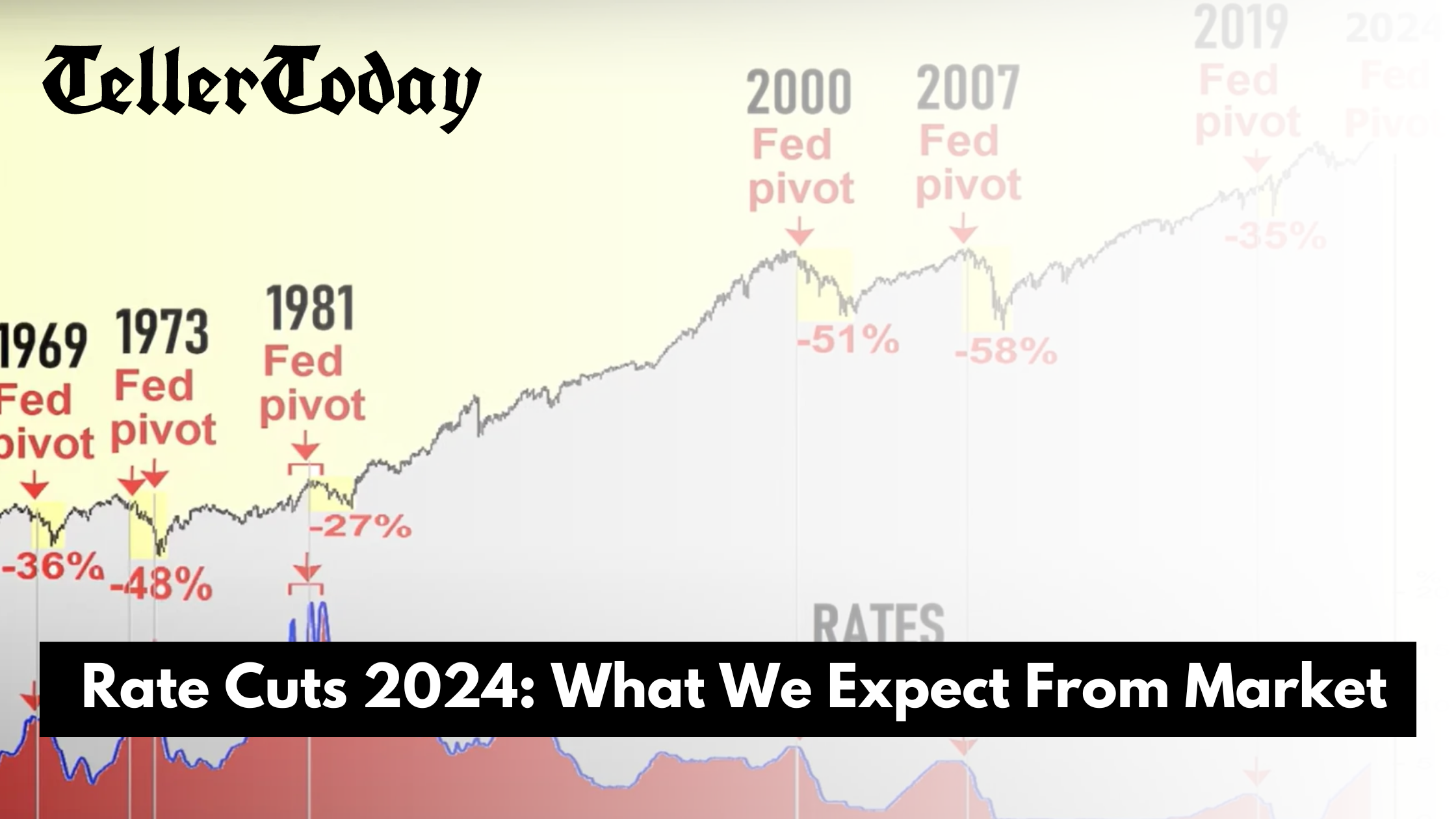

Rate decreases historically affect financial markets greatly. Lower interest rates lower borrowing costs, which boosts company investment and consumer spending.

Since companies gain from lower loans, stock markets frequently perform better. Investors seeking better returns may switch from bonds to stocks, raising stock prices. If the Fed cuts rates in 2024, the stock market will rise. Companies with lower borrowing rates earn more, making equities more appealing to investors.

Since interest rate fluctuations affect technology, consumer discretionary, and housing, these sectors may gain the most. Tech businesses, which need plenty of money for R&D, may prosper amid low interest rates since finances are cheaper.

However, bond market volatility may rise. When interest rates fall, investors value bonds with greater yields, raising their values. Lower rates may tempt investors to buy stocks instead of bonds for higher profits.

However, market responses may be unexpected, and geopolitical concerns and economic shocks may affect results.

Effects on Consumers and Borrowing

Rate cuts lower client loan and mortgage rates. This helps homeowners since federal funds rate drops cut mortgage rates. The real estate business may gain from cheaper financing for homebuyers.

Credit card and student loan interest rates may be reduced, giving clients more discretionary money.

The average 30-year fixed mortgage rate reached above 7% in 2023, peaking after two decades.

Lower borrowing rates assist consumers but have downsides. Low interest rates may encourage family debt and borrowing.

Low savings accounts and fixed-income investment returns may also hurt retirement planning and other financial goals.

Fed rate reduction aims to boost economic growth, but their success relies on the economy. If the economy has fundamental challenges like diminishing productivity or poor global demand, rate decreases may not be adequate to maintain growth.

Lower interest rates may boost spending and investment, creating jobs and economic growth in a climate of high consumer and corporate confidence.The labor market will certainly influence Fed decisions in 2024. If unemployment rises or job growth slows, the Fed may decrease rates to avoid a recession.

SummaryThe possibility of a 2024 Fed rate reduction has market players, companies, and consumers excited. Lowering rates by the Federal Reserve will affect stock market performance and consumer borrowing habits.Rate cuts may improve financial markets and economic development, but they also raise family debt and diminish saving returns.

As 2024 approaches, investors and consumers will follow the Fed's interest rate signals and prepare for any adjustments.

The possibility of a 2024 Fed rate reduction has market players, companies, and consumers excited. Lowering rates by the Federal Reserve will affect stock market performance and consumer borrowing habits.

Rate cuts may improve financial markets and economic development, but they also raise family debt and diminish saving returns.

As 2024 approaches, investors and consumers will follow the Fed's interest rate signals and prepare for any adjustments.

TellerToday collects & utilizes cookies from third-parties & affiliate networks to improve user experience. If you buy a product or service after clicking on one of our links, we may get a commission.